The Cleafy Threat Intelligence team has uncovered SuperCard X, a sophisticated Android malware campaign leveraging NFC-relay attacks to authorize fraudulent POS and ATM transactions. This Malware-as-a-Service (MaaS) operation1 primarily targets Italian banking customers but exhibits potential for global expansion due to its modular infrastructure.

Attack chain & technical mechanics

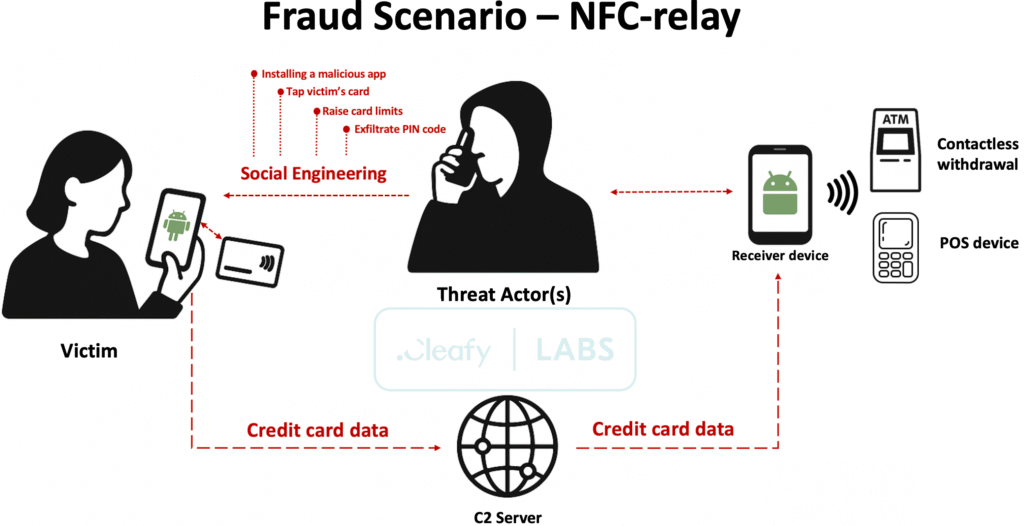

Social Engineering Onramp:

- Initiates via SMS/WhatsApp messages impersonating bank fraud alerts (TOAD attack vector)1

- Threat actors (TAs) guide victims to install the malicious “Reader” app (blue icon) under pretext of canceling fake transactions1

NFC Relay Infrastructure:

xml<!-- AndroidManifest.xml critical permission -->

<uses-permission android:name="android.permission.NFC" />

Dual-application architecture:

- Reader: Harvests NFC card data via compromised devices

- Tapper: TA-controlled app emulating stolen cards using relayed ATR messages1

C2 Communication:

- HTTP protocol with mutual TLS (mTLS) authentication

- Server rejects connections lacking client certificates (400 Bad Request)1

- Real-time data relay enables instant fraudulent transactions

Technical differentiators

- Low-Footprint Design: Only 7 Android permissions requested vs 20+ in typical banking trojans1

- ATR Spoofing: Embedded Answer-to-Reset messages bypass card-reader handshake checks1

- MaaS Customization: text

+ Italian variant removes "Register" button and Telegram references - Retains core NFC data exfiltration logic

Detection Evasion:

- 0/62 AV detection on VirusTotal at discovery

- Minimal behavioral patterns compared to SMS-hijacking malware

IoCs & campaign links

Malware Samples:

- SHA256: 7a8f3b… (Reader variant)

- SHA256: e29c41… (Tapper variant)

C2 Infrastructure:

- 185.65.135[.]88 (Port 443)

- hxxps://api-supercardx[.]com/auth/login

Code Heritage:

- 78% code overlap with NGate malware (ESET 2024)

- NFCGate open-source project code reuse

Defense implications

Financial institutions should:

- Implement NFC transaction velocity checks

- Monitor for abnormal ATR message patterns

- Update fraud detection systems to recognize instant cash-out patterns

- Conduct employee training on TOAD attack recognition

This campaign exemplifies the shift towards protocol-level exploitation over traditional credential theft. The combination of minimal permissions and legitimate NFC API abuse creates new detection challenges requiring behavioral analysis beyond signature-based methods.